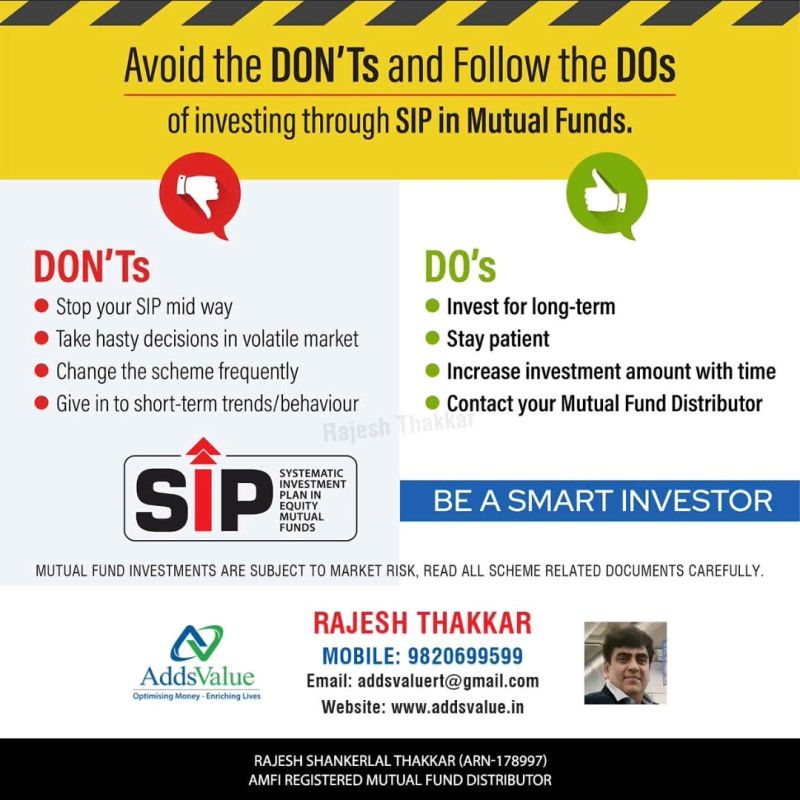

Do invest with a long-term perspective and diversify your portfolio. Don’t chase hot tips or ignore your risk tolerance.

Thank you for reading this post, don't forget to subscribe!Investing can be a powerful tool for building wealth, but it requires a strategic approach. Beginners and seasoned investors alike should navigate the market with a set of proven guidelines tailored to safeguard and grow their investments. The world of investing is vast and can seem complex, but by following some core principles and avoiding common pitfalls, anyone can work towards turning their financial goals into reality.

Disciplined investing, informed decision-making, and understanding the market landscape are essential to successful investment practices. This introduction sets the stage for an exploration of the fundamental do’s and don’ts that every investor should consider, offering a blueprint to minimize risks and maximize potential returns.

Credit: www.debt.org

Navigating The Investment Landscape

Identifying your investment goals is the first step in smart investing. Each person has unique financial objectives. You might aim to buy a house, save for education, or prepare for retirement. Setting clear, attainable goals helps in crafting a tailored investment strategy.

Your risk tolerance and time horizon are crucial factors in your investment journey. Risk tolerance involves understanding how much risk you can handle. Are big market swings scary? Your time horizon tells you how long to invest. Long time? You might handle more risk. Short time? Perhaps choose safer investments.

Credit: www.bankrate.com

The Building Blocks Of A Solid Portfolio

Diversification is not putting all your eggs in one basket. It means spreading your investments. This reduces risk. Different investments respond differently to market changes. By diversifying, you may not lose money all at once. Bonds, stocks, and real estate are different types of investments. Each acts differently over time.

Asset allocation is very important. It’s about deciding where to put your money across different types. How you spread your investments is key to balance. This balance depends on your age and risk comfort. Younger investors often choose more stocks for growth. Older investors may pick bonds for stability. Your goals, timeline, and risk tolerance shape your portfolio. Keep reviewing and adjusting your investments regularly.

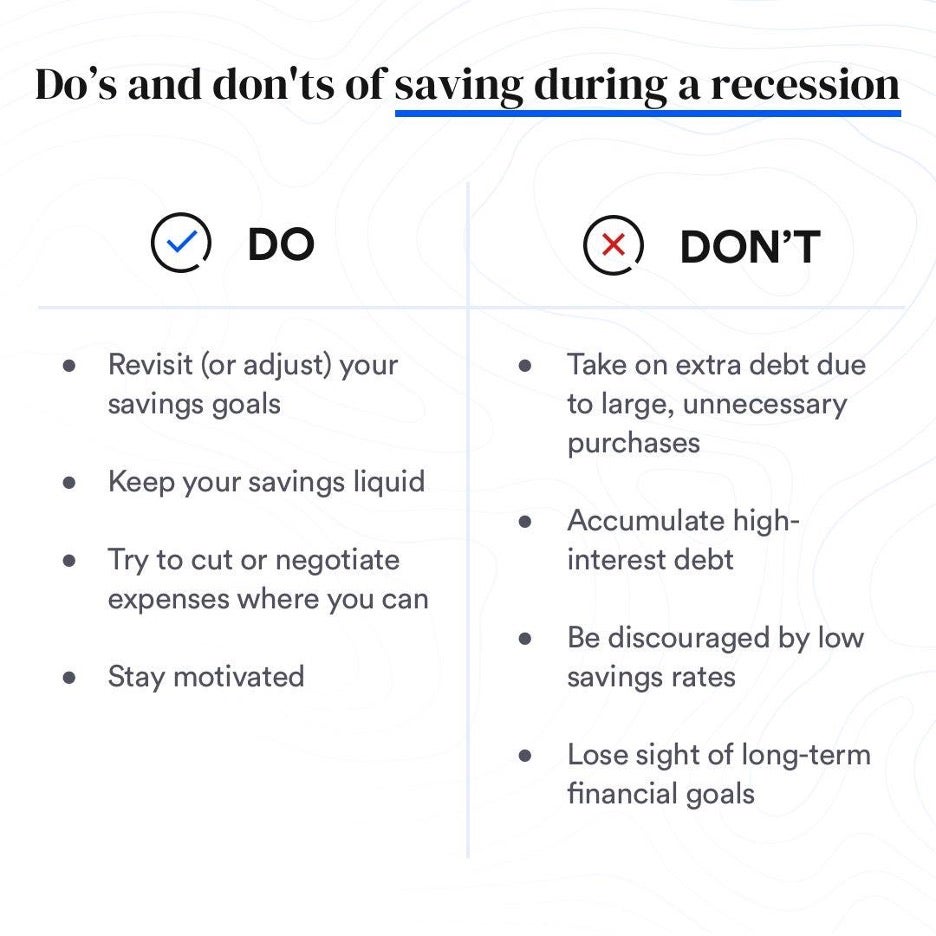

Common Investment Pitfalls To Avoid

Emotional investing often leads to poor decisions. Market swings can surge adrenaline and trigger snap actions. Investors should steer clear of emotional responses. Making choices during high volatility may harm long-term goals. Keep a cool head and remember your strategy.

Timing the market is a game of chance. It’s risky and often unwise. Many try, but predicting market highs and lows is notoriously difficult. Instead, consider a consistent investment approach. This means investing regularly, no matter what the market does. It’s a safer bet for most people.

Credit: www.linkedin.com

Smart Investor Habits

To become a smart investor, embrace the habit of regular portfolio reviews. This means checking how your investments perform often. You should do this at least once a year. It’s also about rebalancing your assets. This ensures your risk levels stay where you want them.

Knowledge is powerful, so keep learning about markets. Yet, don’t let emotions drive your decisions. There’s a fine line between staying informed and becoming obsessed. Sure, watch the news and read articles, but don’t check your investments every day. That’s a recipe for stress, not success.

Leveraging Professional Advice And Tools

Seeking a financial advisor’s expertise often pays off. It’s crucial for complex investment decisions. Smart investors acknowledge they don’t know everything. Guidance can mean the difference between success and failure. Knowing your own limitations is key. Talk to an advisor when facing big choices or changes in your financial landscape.

Embracing investment apps and platforms streamlines the investment process. These tools provide real-time data and insightful analytics. They help you make informed decisions. Choose platforms with strong reviews and proven track records. Apps should offer ease of use and dependable support. Before relying on a digital tool, check its credentials and costs. Doing so ensures smart, efficient investing.

Frequently Asked Questions On The Do’s And Don’ts Of Investing For Everyone

What Are Key Investment Strategies?

Successful investment strategies often include diversification, regular contributions, a clear understanding of risk tolerance, and setting long-term goals.

How To Avoid Common Investing Mistakes?

Steer clear from frequent trading, allowing emotions to drive decisions, neglecting diversification, and skipping on research to minimize common investing errors.

What Are The Best Practices For New Investors?

New investors should start with clear goals, invest consistently, prioritize learning, and seek advice from seasoned professionals for best practices.

Can Anyone Start Investing With A Small Amount?

Yes, even with a limited budget, individuals can begin investing through options like low-cost index funds, fractional shares, and automatic investment plans.

Conclusion

Embracing the right mix of investment wisdom is key to financial growth. Ensure you stay informed, balance risks with rewards, and resist following fleeting trends. Your prudent choices today chart a secure path for your financial future. Stick to these investment principles, and watch your portfolio thrive.

Happy investing!