Intro

In the rapidly shifting landscape of investment opportunities, understanding where to allocate your resources can seem daunting. Whether you’re a seasoned investor or just starting out, it’s crucial to stay updated on the latest trends and opportunities. Here’s a glimpse into what the UK’s current investment climate looks like, and where your money could potentially yield the most returns.

Thank you for reading this post, don't forget to subscribe!The Allure of Tech Start-ups

There’s a magnetic pull towards the vibrant tech start-up scene in the UK. Over the past decade, this sphere has catapulted into prominence, earning London the moniker of Europe’s Silicon Valley. A hotbed for disruptive and innovative ventures, these start-ups constantly push the boundaries, introducing novel solutions to age-old problems and reimagining how we live and work.

What captures investors’ attention is not just the potential for sky-high returns, although that’s certainly a draw. Investing in tech start-ups also offers a chance to play a part in the genesis of groundbreaking technologies. It’s an opportunity to nurture ideas that could potentially revolutionize industries, transform societies, and reshape the world as we know it.

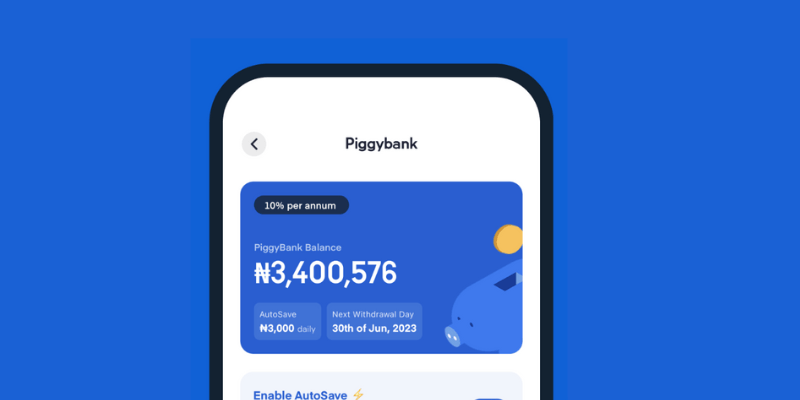

From fintech and edtech to healthtech and proptech, the tech sector’s expansive spectrum implies that there’s likely something for every investor’s appetite. Each subsector presents its own unique set of opportunities and challenges, enabling investors to diversify their portfolio while investing in areas they’re passionate about.

But it’s not all smooth sailing. As with all investments, there are risks associated with tech start-ups. Not all will succeed and reach the sought-after unicorn status. Some will falter, and others may fail outright. It’s crucial to do your due diligence, understand the start-up’s business model, and gauge the competency of the team before investing.

Nonetheless, the allure of tech start-ups is undeniably compelling. It’s about more than just financial returns. It’s about being part of something bigger – a wave of innovation that’s disrupting the status quo and shaping the future.

Investing in Green Energy

Green energy is a sector that is lighting up the investment radar in the UK. There’s a palpable global shift toward sustainable energy sources and the UK is fervently stoking the fires of this green revolution. The government’s ambitious goal to achieve net-zero carbon emissions by 2050 has triggered a surge in green energy enterprises, making it a fertile ground for potential investments.

There’s a particular shine on companies specializing in wind and solar power. These renewable energy sectors are gaining traction, powered by advancements in technology and an increasingly favorable regulatory environment. Investing in these arenas could yield significant returns over the long haul.

Green energy is not just about being environmentally responsible. It’s about identifying and seizing a booming business opportunity. It’s about backing companies that are harnessing wind, sun, and water to power the future. It’s about riding the wave of a sector that’s poised to reshape the energy landscape, driven by global demand and governmental support.

However, as with any investment, it’s essential to tread with caution. Thorough research and analysis of the company’s fundamentals, the industry’s growth prospects, and the broader market conditions are key to making informed decisions. Be mindful of the fact that while the rewards can be high, the risks associated with green energy investments can also be significant.

This investment trend is not just about turning a profit, but also about making a positive impact. Green energy investments allow you to contribute to a cleaner, more sustainable future while potentially reaping financial rewards. It’s the epitome of doing well by doing good.

Overall, the green energy sector in the UK represents a vibrant and growing market, offering a multitude of opportunities for investors who are eager to generate returns while contributing to a greener future.

Real Estate: Still a Good Bet

The real estate market in the UK has proven its tenacity, even amidst the economic disruptions spurred by the global pandemic. As a pillar of stability, it’s hard to overlook the potential of property investment. There has been a notable upswing in property values, particularly in regions outside London. This surge signals an enticing opportunity for investors to grow their capital.

While it’s true that the real estate market isn’t impervious to market swings and economic downturns, it tends to be more resistant to short-term volatility. Its ability to generate steady, reliable returns makes it a valuable component of any robust investment portfolio. Additionally, its intrinsic value tends to rise over time, allowing it to serve as a reliable shield against inflation’s erosive effects.

This isn’t to say that real estate investing is a sure-fire bet. Like all investments, it requires careful analysis, planning, and a degree of risk tolerance. But for those willing to do the groundwork and remain patient, the property market can yield attractive rewards.

From buy-to-let properties and commercial spaces to development projects and REITs (Real Estate Investment Trusts), there’s a spectrum of options available for different investment strategies and risk appetites. Whether you’re a hands-on investor who enjoys the thrill of flipping properties or prefer a hands-off approach with REITs, the UK’s real estate market offers a playground of possibilities.

At the heart of it all, real estate investing isn’t just about the pursuit of profit. It’s also about the tangible satisfaction that comes from owning a piece of the Earth, a physical asset that you can see, touch, and use. So, as you scan the investment horizon, don’t forget to consider the tried-and-true real estate market. Because even in today’s dynamic, tech-driven investment landscape, it remains a good bet.

Infrastructure Investment Opportunities

Riding the wave of infrastructure transformation in the UK could be an interesting investment journey. With the government’s bold initiative to inject a whopping £640 billion into infrastructure over the coming decade, the potential for steady, substantial returns is certainly appealing. This vast array of projects, spanning from enhancements in road and rail networks to digital infrastructure upgrades, paves the way for long-term growth prospects.

Investing in infrastructure isn’t just about capitalizing on lucrative opportunities. It’s about participating in the nation’s growth story, contributing to projects that improve quality of life and fuel economic progress. These projects can create jobs, spur innovation, enhance connectivity, and uplift communities. Therefore, as an investor, you’re not merely watching your capital grow, but also witnessing tangible improvements in the country’s fabric.

One of the highlights of infrastructure investments is their relatively low correlation with other asset classes. This unique feature lends a diversification advantage, enhancing the robustness of your portfolio by mitigating risk. It’s like adding a shock absorber to your investment vehicle, providing stability amidst market fluctuations.

However, let’s not overlook the fact that these investments come with their own set of risks and challenges. Like any investment, it’s essential to thoroughly analyze potential projects, considering factors such as financial viability, project timelines, regulatory hurdles, and potential environmental impacts. Engaging in due diligence can make the difference between a successful investment and a costly misstep.

From bridges and broadband networks to power plants and public transportation, the scope of infrastructure investments is broad and varied. It allows you to align your investments with your interests, whether you’re passionate about green energy, keen on improving transportation, or enthusiastic about digital transformation.

The surge in infrastructure development in the UK is a phenomenon that offers more than just financial gains. It’s a chance to contribute to the nation’s progress while potentially adding a solid, growth-oriented component to your investment portfolio. So, as you contemplate your next investment move, consider the vast, evolving landscape of UK infrastructure.

E-commerce Boom and Retail Investments

Step into the fast-paced world of e-commerce, where the online shopping boom in the UK is generating enticing investment opportunities. The digital marketplace has exploded into the mainstream, becoming an integral part of consumers’ lives and reshaping the retail industry. From giants like Amazon to emerging online boutiques, the e-commerce sector is brimming with potential for shrewd investors.

The pandemic has significantly amplified this trend, compelling traditional brick-and-mortar retailers to pivot towards the digital realm. E-commerce isn’t just an emergency response to social distancing measures; it’s a transformative wave that’s redefining the retail landscape. The surge in online shopping isn’t a fleeting phenomenon but rather a permanent shift in consumer behavior.

But the investment opportunities aren’t confined to e-commerce platforms alone. The ripple effect of this boom is felt across the entire e-commerce ecosystem. Companies that facilitate online transactions, like digital payment processors and cybersecurity solutions, present lucrative prospects. Similarly, logistic companies that ensure seamless delivery of online orders are also reaping the benefits of this boom.

Even though the e-commerce sector is on an upward trajectory, it’s important to remember that not all investments in this arena will necessarily prosper. Rigorous research, careful evaluation of business models, and understanding of market trends are paramount in distinguishing the winners from the losers.

When considering investments in e-commerce and related sectors, it’s not just about riding the wave of a booming industry. It’s also about participating in a fundamental shift in commerce, one that’s breaking down geographic barriers and democratizing access to goods and services.

Investing in e-commerce is more than just a chance to grow your wealth. It’s an opportunity to participate in a retail revolution, one that’s forging a digital future for commerce. As you navigate the investment landscape, don’t overlook the vibrant and rapidly evolving world of e-commerce and retail investments.

Health and Wellness Sector

The health and wellness industry in the UK is brimming with vitality, experiencing a dramatic surge in recent times. With a burgeoning market for everything from innovative biotech treatments to virtual fitness classes, this sector is a potential gold mine for perceptive investors. A shift in consumer attitudes towards a more health-conscious lifestyle has accelerated demand for wellness products and services.

The spectrum of opportunities is extensive, catering to a variety of investor interests. Biotech companies at the cutting edge of medical research are uncovering revolutionary treatments, a pursuit that not only holds promise for investors but can also lead to significant advancements in healthcare. Wellness brands are finding their niche, providing holistic products and services that promote better health, fitness, and mental well-being. Digital platforms offering virtual fitness classes are capitalizing on the current trend of home workouts, providing an avenue for potential investment.

Simultaneously, the rise of personalized medicine, telehealth, and health tech startups are aspects that further underline the robust growth trajectory of this sector. The accelerated adoption of these technologies during the pandemic has resulted in a paradigm shift in healthcare delivery and is likely to continue to be a game-changer in the years to come.

Yet, as enticing as these opportunities may be, it’s crucial to approach with a discerning eye. As with any investment, there’s a need for careful analysis of market trends, business models, and growth potential. Understanding the unique challenges of the health and wellness industry – such as regulatory hurdles, patent issues, and the need for continual innovation – is key to making astute investments.

In essence, investing in the health and wellness sector is not just an opportunity for potential financial gains, it’s also a chance to contribute to the well-being of society at large. It’s about backing companies and concepts that are empowering people to live healthier, more balanced lives. As the sector continues to evolve and innovate, the prospects for investment and societal impact are immense.

AI and Automation Opportunities

In the global industrial landscape, Artificial Intelligence (AI) and automation are not just fleeting trends; they’re transforming the way businesses operate. The UK is leading the charge in this technological revolution, making it an attractive arena for potential investments. Companies harnessing these cutting-edge technologies are breaking new grounds in various sectors, including healthcare, finance, and manufacturing, signaling ample growth opportunities for investors.

These technologies are shaping the fourth industrial revolution, a disruptive shift that’s upending traditional business practices. From automating mundane tasks to streamlining complex processes and predicting market trends, AI and automation are proving to be game-changers.

Healthcare companies are leveraging AI to diagnose diseases accurately and swiftly, improving patient outcomes. In finance, automation is being used to streamline transactions and enhance customer experiences. Manufacturers are deploying these technologies to optimize their production lines and reduce operational costs.

But the investment opportunities are not just confined to these sectors. Tech start-ups specializing in AI and automation are sprouting across the UK, each with innovative solutions and immense growth potential. As these companies mature, early investors may reap significant returns.

However, it’s essential to approach these opportunities with a discerning eye. Not every start-up will survive the competition or overcome the regulatory and technical challenges inherent in this field. Conducting thorough research and understanding the company’s business model, the scope of its technology, and its growth potential are critical to identifying winners.

Investing in AI and automation isn’t just about capitalizing on an emerging trend; it’s about participating in a technological revolution that’s reshaping the world. It’s about backing the companies that are at the helm of this transformation, leading the way towards a future where AI and automation are ubiquitous.

As an investor, this wave of innovation in AI and automation presents an opportunity to diversify your portfolio and potentially reap substantial returns. It’s an exciting time to explore this dynamic and rapidly evolving sector, teeming with opportunities for those willing to delve into the realm of AI and automation. So, as you chart your investment course, be sure to consider the compelling opportunities in AI and automation.