To save or invest with Piggyvest, create an account, choose a savings plan, and deposit funds. Navigate through investment options and set up an auto-save feature for consistency.

Thank you for reading this post, don't forget to subscribe!Piggyvest has emerged as a popular online platform that allows individuals to manage their finances with ease. With a range of features tailored to bolster savings and investment habits, this digital piggy bank caters to a diverse clientele. Users can effortlessly start with Piggyvest by signing up, verifying their details, and exploring the various savings and investment packages available.

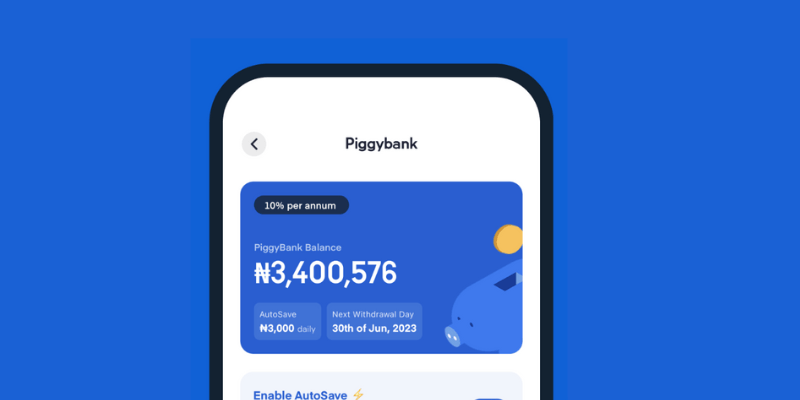

This fintech innovation simplifies the journey towards financial discipline, offering users the flexibility of daily, weekly, or monthly contributions. The platform operates with the mission of making saving money not only accessible but also rewarding, as it provides competitive interest rates. Piggyvest’s intuitive interface and robust security measures assure users a safe and convenient way to grow their wealth over time.

Credit: m.facebook.com

The Piggyvest Phenomenon

The digital age has revolutionized how we save and invest our money. Traditional piggy banks have evolved into sophisticated online platforms, like Piggyvest. This platform makes managing finances easy and accessible for everyone. Users can set savings goals, track progress, and earn interest on their deposits. It’s a convenient and secure way to grow your funds.

Adopting Piggyvest can lead to financial discipline and long-term monetary gains. Small, regular deposits can accumulate over time, creating a substantial savings buffer or an investment pot. This is the essence of digital savings growth. And with features such as automated savings plans and various investment options, Piggyvest stands out as a leader in this space.

Getting Started With Piggyvest

To save or invest money with Piggyvest, one must first create an account. The process is simple and user-friendly. Users need to provide some basic information. This includes their name, email, and phone number. A verification link will be sent to the provided email.

Once the account is set up, users can explore the Piggyvest platform. The dashboard is easy to navigate with clear icons and menus. Features like savings plans, investment opportunities, and account settings are easily accessible. Users can start saving with just a few clicks.

Understanding Piggyvest Savings Options

Piggyvest offers users a way to grow savings effortlessly. Their core savings features are designed to enhance your financial discipline.

Safelock stands out by allowing account holders to lock funds. Funds are untouchable for a set period. This guarantees savings growth.

The service provides flexibility in choosing the lock period. You decide when your money gets locked and released. It’s like having a digital piggy bank that adapts to your needs.

Investment Opportunities On Piggyvest

Piggyvest offers a platform known as Investify. It allows users to invest in pre-vetted opportunities. Understanding the balance between risk and potential returns is crucial. Each investment option on Investify has detailed information for easy assessment. Users should consider factors like duration, interest rates, and the credibility of partners. Investify ensures that all listed investment opportunities are subject to strict due diligence. This helps in reducing the risk that investors face. Diversification across multiple opportunities can minimize potential losses. Always review the terms and policies of investments before committing funds. It’s a good practice to start with smaller amounts, increasing investments as one grows more comfortable.

Maximizing Your Earnings

Understanding interest rates and account types is key to maximizing earnings. Piggyvest offers various savings and investment options. Each option provides different interest rates, tailored to meet unique financial goals.

Savvy saving strategies with Piggyvest can lead to substantial growth. Regular deposits into a Target Savings account nurture discipline and ensure steady account growth. Embracing the SafeLock feature locks funds away, preventing impulsive spending and securing higher interest rates.

To amplify your savings journey, consider flexible savings options. These allow for easy access to funds while earning competitive interests. Diversifying investments across different account types can balance risk and optimize returns. Piggyvest’s Investify platform offers access to low-risk investment opportunities, creating a robust financial portfolio.

Credit: medium.com

Security And Support

Piggyvest ensures the safety of your money using top-notch security measures. Your investments and savings are protected with bank-level security, which includes two-factor authentication (2FA) and 256-bit encryption. The platform is also PIDM insured, meaning your funds have added protection.

Their customer service is aimed at delivering a seamless user experience. You can reach out to them through various channels, including email, live chat, and phone support. They are known for their quick response time and effective solutions to concerns raised by users. User satisfaction is a top priority for Piggyvest, reflected in their vigilant customer support team.

Credit: theouut.com

Frequently Asked Questions On How To Save Or Invest Money With Piggyvest (piggy Bank)

What Is Piggyvest?

Piggyvest is a Nigerian fintech platform that enables users to save and invest money securely online, offering various savings and investment options.

How Does Piggyvest Guarantee Safety?

Piggyvest uses bank-level security features, including 256-bit SSL encryption, to ensure the safety and privacy of users’ financial information.

Can I Withdraw Money From Piggyvest Anytime?

Piggyvest offers flexible withdrawals that may include specific penalty-free dates or conditions depending on the savings plan chosen by the user.

What Investment Options Does Piggyvest Provide?

Piggyvest provides users with a range of investment options, including fixed deposits, government bonds, and agricultural investment opportunities.

Conclusion

Embracing Piggyvest can transform your financial habits, guiding you towards prudent savings and investments. This accessible tool offers a flexible route to grow your funds, whether for short-term goals or long-term gains. Start charting a path to a more secure financial future by trying Piggyvest today – your wallet will thank you.